GIPE Newsletter (Nº24.159) April, 29th 2025

TAXES:

REFERENCE VALUE: TAX IMPLICATIONS FOR REAL ESTATE TRANSFERS

When a property is acquired, whether through purchase, gift, or inheritance, it is important to consider the reference value of the property to correctly determine the taxes payable, whether it be the Property Transfer Tax (ITP) or the Inheritance and Gift Tax (ISD).

- In the case of a purchase and sale, the ITP will be calculated on the highest of the transaction price and the reference value.

- In the case of donations or inheritances, the ISD must be paid based on the highest of the reference value and the value indicated in the public deed.

What is the reference value?

This value is determined annually by the General Directorate of Cadastre, based on the purchase prices registered with a notary and grouped by area. It is published simultaneously for all municipalities and can be consulted online on the Cadastre website:

https://www1.sedecatastro.gob.es/Accesos/SECAccvr.aspx

Important: the reference value cannot exceed the market value of the property. If you believe this condition is not met, you have the right to challenge it.

How can you appeal the reference value?

There are two ways to do so:

- Self-assess according to the reference value and then request a correction, questioning said value. This option is the most cautious to avoid penalties.

- Declare the value you consider fair and, if the Treasury opens an audit, then challenge the reference value used by the Administration.

Cases in which the reference value does not apply

There are certain situations in which a reference value is not assigned to the property, such as:

- Illegal occupation: if the property is occupied without consent at the time of the transfer.

- State of dereliction: when the property is in a dilapidated condition.

- Regulated price: if the property is subject to a maximum price set by regulations.

RESIDENTIAL LEASES:

ENDING THE RENTAL AGREEMENT: HOW TO RECOVER YOUR PROPERTY

Notice Period

One of your lease agreements will end this year due to the expiration of the term, and you wish to recover the property. Important! In the case of rentals for primary residences, you must notify the tenant of your decision not to renew at least four months before the end of the contract. If you fail to do so, the contract will be automatically extended for annual periods, up to a maximum of three years, always to the tenant’s benefit.

How to Notify

To avoid problems, you must inform the tenant in a reliable manner by sending the notice to the address indicated in the contract for communications, which is usually done by registered letter or certified letter with acknowledgment of receipt and certificate of contents.

Important note: Even if the tenant does not collect or rejects the notice, if you sent it correctly and within the deadline, the communication will be considered valid in court. Specifically:

It will be deemed properly served if it is sent on time to the address agreed upon in the contract, even if the tenant is not present at the time.

It will also be valid even if the tenant decides not to collect the notice or not to attend service at the designated location.

Who Must Send the Notice?

However, the tenant is not obligated to accept service from third parties. Therefore, if you do not sign as the sender or the communication is sent by another person without identifying you, the tenant may legitimately reject it.

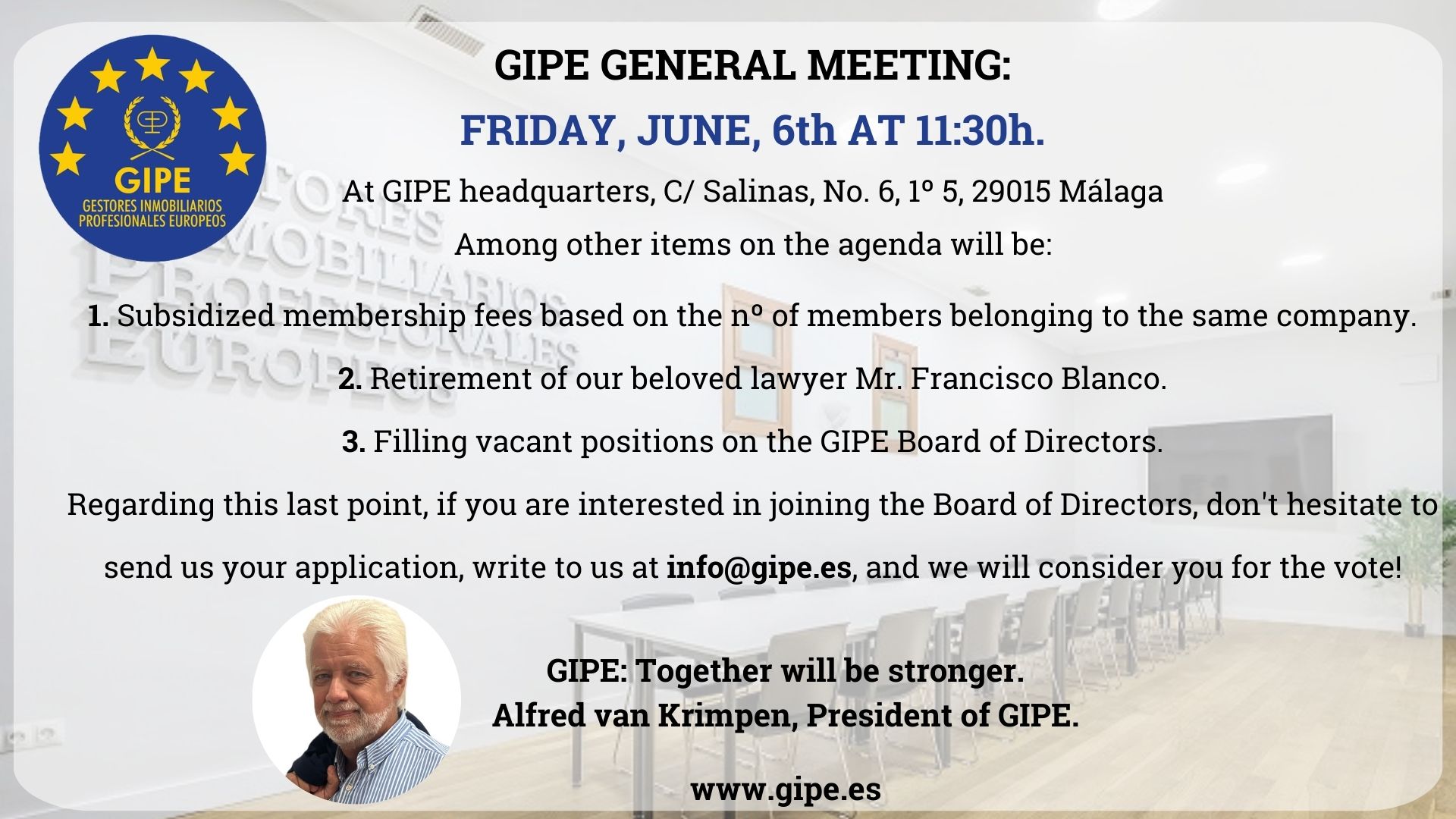

GIPE: Together we will be stronger